Life Insurance

Why Get Life Insurance? A life insurance policy is something of a security blanket. It brings comfort as you know that your loved ones will be looked after in the event that something happens to you. This policy is designed to provide your dependants with financial support in the event you lose your life. One […]

Home Insurance

Why Get Home Insurance? Owning a home may be your biggest investment, so wouldn’t you want to protect it? Having home insurance can protect you from having to pay a large lump sum to repair damages to your property and personal belongings if something happens to or in your home. And even though home insurance […]

Travel Insurance

Why Get Travel Insurance? Can you afford to cancel and rebook your trip? Is your trip refundable? Does your health insurance cover you abroad? If you answer no to one or both of these questions then, you should consider travel insurance. Whether you are traveling for business or leisure, travel insurance can help give you […]

Health Insurance

Why Get Health Insurance? You might not be able to buy health and happiness, but enrolling in a health insurance plan can give you the peace of mind that promotes both. In addition to protecting against the cost of medical emergencies, health insurance works to keep you healthy with the inclusion of coverage for preventative […]

Motor Insurance

Why Get Motor Insurance? Motor insurance is a fundamental necessity for all vehicle owners, offering protection against potential damages and liabilities that arise from accidents, natural disasters, or other covered, unforeseen events. It provides financial security by covering repair & medical costs and safeguarding you from unexpected expenses. Knowing you have coverage allows you to […]

What Is An Annuity?

When you reach retirement age, you might want to think about buying a guaranteed income from your pension pot. This is known as an annuity. A retirement annuity can give you a guaranteed income for the rest of your life. You can also choose to receive an annuity for a fixed number of years. You pay […]

Why Is Insurance Important And What Can You Protect?

Risk vs. Protection Insurance is all about managing risk. Some insurance is compulsory, for example, automobile insurance for drivers. You might need other insurance as a condition of the contract, like homeowner’s insurance if you have a mortgage on your home. Most other insurance types are a matter of choice, and involve you prioritising what’s […]

Protection At Different Stages Of Your Life

Protecting what matters usually involves having to balance the cost of protection with the risks you face. Everyone is different, but there are a number of specific life stages where certain insurance coverage or protection may be particularly relevant. Here are some illustrative examples: Justin Justin is a 30-year-old college lecturer, living with his partner […]

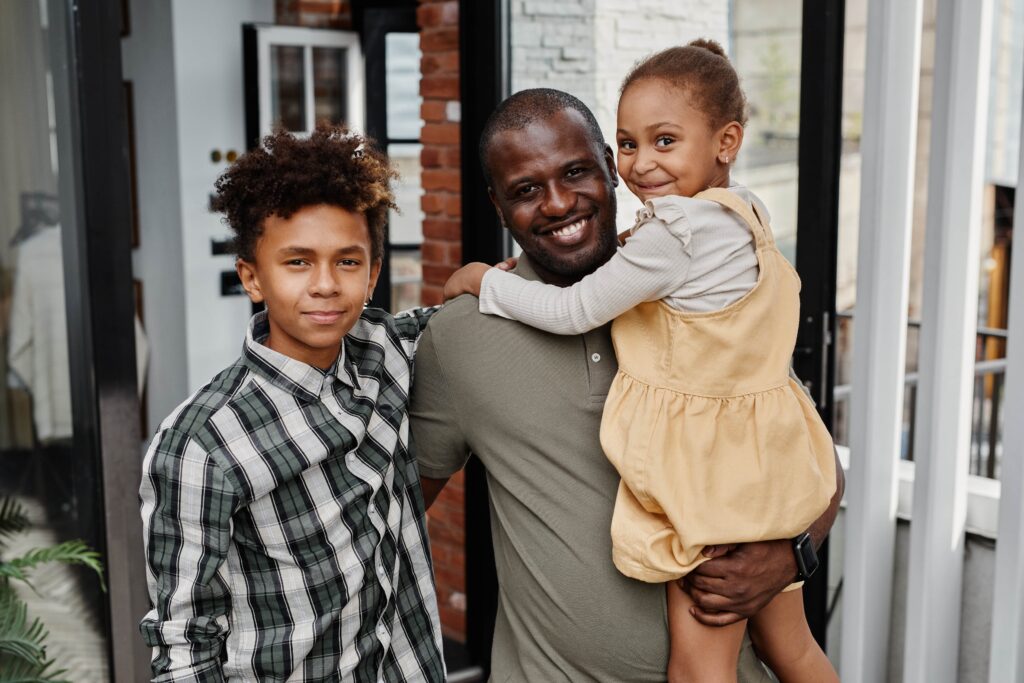

Protecting Your Loved Ones

In protecting your financial future, we outlined how a life insurance policy can provide reassurance that your loved ones will be looked after and better able to cope financially if you’re no longer there to provide for them. However, there are many other ways you can protect the people that you love. Here are some of […]

Protecting Your Financial Future

Protecting your financial future isn’t just about taking out insurance to protect you against life’s risks. It’s also about deciding how and where to put savings aside to protect the people and things that you love, and to ensure you’re prepared financially if things don’t go to plan. Our future-planning guide in Savings Strategies will help you. […]